No Pre-Closure Charges on Business Loans – Is It Beneficial?

Most business owners don’t take loans because they want to stay in debt. They take them because, at a certain point, external financial support becomes necessary to sustain operations. It could be to manage working capital, handle a slow cycle, or simply to avoid disrupting day-to-day activity.

What many businesses don’t realize at the time of borrowing is that a loan doesn’t just affect cash flow when you take it; it also affects you when you want to close it. Pre-closure charges often come into the picture later, when the business is finally in a position to reduce liabilities early.

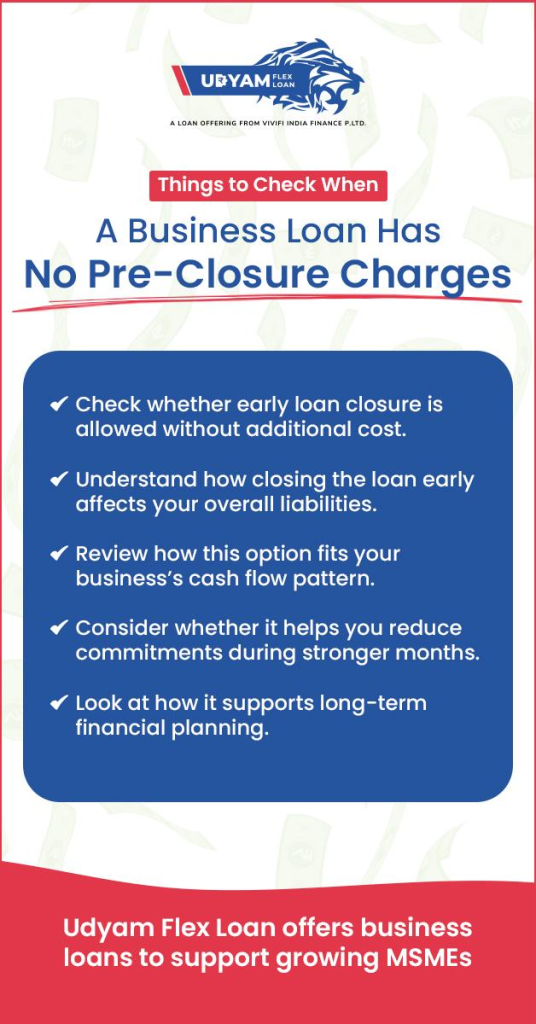

So if you’re planning to apply for a business loan, it’s worth asking a simple question upfront: Does a loan with no pre-closure charges actually offer better long-term value? Understanding this can help you judge the real benefits of business loans, not just the immediate access to funds.

Table of Contents

What Pre-Closure Charges Mean in Practical Terms

Pre-closure charges are applied when a borrower decides to close a business loan before the scheduled end date. From a lender’s perspective, this offsets the income they expected to earn over the full loan period.

From a business owner’s perspective, the situation looks different. Many MSMEs take loans during tight phases and later experience improved cash flow. When surplus funds become available, closing the loan early feels like a sensible move. However, pre-closure charges can reduce the benefit of doing so.

This is why businesses evaluating business loans benefits should look beyond approval speed and loan amount. If you plan to apply for a business loan, understanding how exit terms work is just as important as understanding entry terms.

Is a business loan without pre-closure charges really beneficial?

- It allows early loan closure without additional costs

- It supports businesses with uneven cash cycles

- It gives owners more control over liabilities

- It reduces long-term financial pressure

- It fits better with real MSME cash-flow behaviour

Continue reading to understand when this feature truly helps.

Why MSMEs Pay Close Attention to Pre-Closure Flexibility

Most MSMEs do not operate on predictable monthly patterns. Client payments may come late, orders may be seasonal, and expenses do not always follow a neat schedule. Because of this, flexibility becomes one of the most practical business loan benefits.

When a business receives an unexpected inflow, say, a delayed payment finally clears, it may want to reduce outstanding liabilities immediately. If pre-closure charges apply, the decision becomes complicated.

This is why many MSMEs, when applying for a business loan, actively seek options that allow them to repay the loan early without penalty. It gives them room to adapt, rather than locking them into a rigid structure.

Business Loans Benefits That Matter Beyond Disbursal

Access to funds is important, but it is not the only factor that determines whether a loan truly works for a business. Over time, other aspects start to matter just as much.

Real business loans’ benefits include:

- The ability to adjust liabilities as cash flow improves

- Clear understanding of loan behaviour across its lifecycle

- Reduced dependency on informal borrowing during gaps

- Better alignment between business income and financial commitments

When business owners apply for a business loan, these factors often decide whether the loan feels supportive or restrictive six months down the line.

How No Pre-Closure Charges Support Better Financial Planning

Financial planning for MSMEs is rarely static. Plans change as market conditions, client behaviour, and operating costs shift. Loans that allow early closure without penalties fit better into this reality.

If excess funds become available, a business can reduce debt instead of carrying it unnecessarily. This improves liquidity and lowers exposure over time.

For businesses planning to apply for a business loan, this flexibility strengthens overall financial control. It also turns pre-closure freedom into one of the more meaningful business loan benefits, especially for enterprises managing temporarily cash flow gaps.

When No Pre-Closure Charges Make a Real Difference

Not every business will close a loan early. But for certain MSMEs, this option becomes particularly valuable:

- Businesses with seasonal revenue

- Enterprises dealing with variable client payment cycles

- MSMEs use loans for short-term working capital

- Owners aiming to gradually reduce debt exposure

In these situations, choosing a loan without pre-closure charges gives businesses more control. When you apply for a business loan, selecting flexibility upfront can prevent constraints later.

Conclusion

No pre-closure charges are not just a minor feature in a loan agreement. For MSMEs, they can significantly influence how comfortably a business manages its finances over time.

When assessing business loans’ benefits, it’s important to look beyond access to funds and consider how the loan behaves if your situation improves. A loan that allows early closure without penalties supports smarter financial decisions.

If you’re planning to apply for a business loan, options like Udyam Flex Loan, designed with MSME realities in mind, offer both access to funds and the freedom to reduce liabilities when the opportunity arises.