How Credit Score Impacts Your Small Business Loan Approval in India

Table of Contents

What is Considered a Good Credit Score?

Lenders have various credit criteria, and what they consider acceptable. The acceptance factors can affect the terms and conditions, along with the interest rates of a loan. A credit score within the lender’s preferred range can improve the chances of getting a loan with favourable conditions. The following are the range of credit scores and how they are perceived:

High Credit Score (750+)

Credit scores above 750 are generally considered excellent, as they indicate that the borrower has a history of timely repayments. With a credit score like this, the borrower can expect favourable interest rates and terms and conditions when negotiating for the loan, depending on the lender.

Additionally, there are several other benefits of a good credit score, such as:

- Faster approvals

- Better repayment flexibility

- Better lender confidence

- Higher negotiation power

Decent Credit Score (650-749)

Credit scores around this range are not bad, but they are not considered great either. Borrowers can still secure a loan with these credit scores, but usually at higher interest rates. The borrowers in this range can opt for business loans from NBFC-backed lending apps, as their criteria differ, meaning the loan can still be approved if the score falls within their acceptable range.

Low Credit Score (650 or Lower)

A credit score of 650 or lower may not be favoured by lenders as it is seen as an indicator of a turbulent borrowing history. However, many lenders also evaluate business stability, income consistency, and operational history alongside credit scores, so a loan approval is still possible.

Why is Credit Score Important For your Small Business Loan Approval?

The credit score can affect loan eligibility and approval rates. A higher credit score can get the borrower favourable interest rates and repayment terms with the loan approval. On the other hand, a lower credit score may not get the expected loan, but approval is still possible. While a credit score is important, lenders often assess it alongside business performance indicators.

How a Less-than-ideal Credit Score Stunts Your Business’ Growth

- Lenders charge higher-than-usual interest rates.

- Approval timelines may be longer due to additional checks.

- Repayment terms may be stricter.

So how can MSMEs address this? Keep on reading to know!

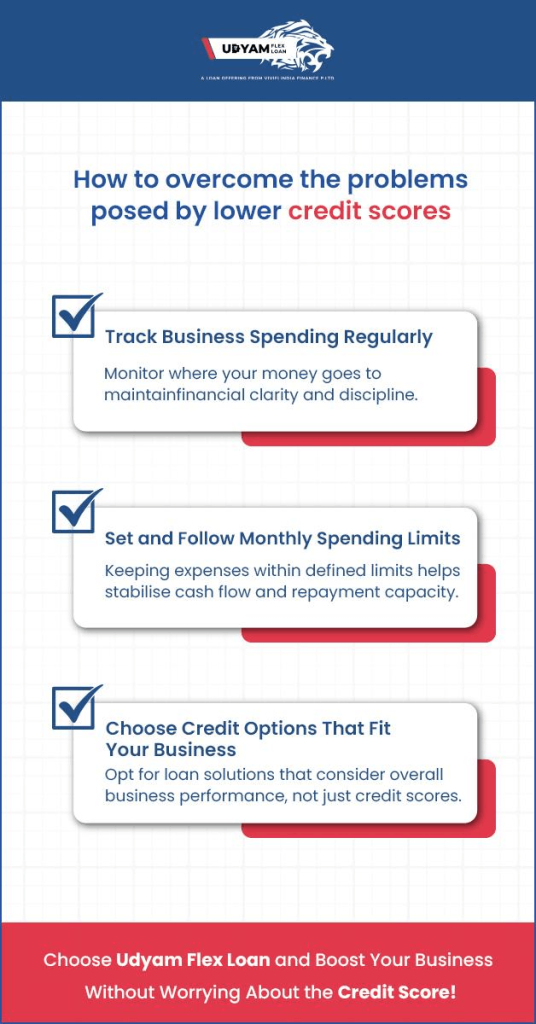

Steps to Improve Business Credit Score Impact

- Reduce Credit Card Utilisation – Lower the credit card usage to balance and restore the credit score monthly. Setting a monthly spending limit and not crossing it can help the credit score bounce back.

- Business loans and EMIs – Business loans and EMIs also play a role in shaping credit scores, so it is important to maintain repayment discipline. Even smaller business loans that are repaid consistently can improve the credit score over time.

- Overdrafts and credit lines – Overdrafts and credit lines can help your credit score when utilised properly. But it is important to keep the usage within limits, and avoiding maxing out can improve the credit profile.

- Clear Bills on Time – Ensure that all the monthly bills tied to the credit card are paid on time, as delayed payments affect the credit score negatively.

- Limit Credit Inquiries – Avoid creating new credit applications or bills before applying for a business loan, as they temporarily lower your credit score, which will affect your chances of securing a loan.

- Diversify Your Credit Mix – It is better to use different credit accounts instead of relying on only a credit card for your spending. Using options like instalment credit instead of relying only on revolving credit helps the credit score go up.

Udyam Flex Loan Can Help Strengthen Your Business Credit. Apply Today!

How Udyam Flex Loan Helps MSMEs

While traditional lenders often place a heavier weight on credit scores, Udyam Flex Loan follows a more balanced assessment approach. If you have a less-than-ideal credit history, you can still get approved, as there are other factors, such as a minimum monthly turnover of ₹30,000 and above, MSME / Udyam registration status, and at least 6 months of operational history, that are taken into consideration to see if the business fulfils the criteria. In addition to that, Udyam Flex Loan also offers the following benefits:

- No Collateral Needed – The loans are unsecured and do not require any asset pledging.

- Multiple Business Areas Covered – Udyam Flex Loan covers a wide range of services across industries.

- Simple Application Process – Fill in the details, upload the documents, and get the loan approved.

Conclusion

Small businesses in India struggle with multiple challenges, and they struggle even more when applying because of problems with small business loan approval credit score. A good credit score improves approval chances, while other business factors also support eligibility.

With a helping hand like Udyam Flex Loan, applying for and obtaining a business loan can become easier since Udyam Flex Loan provides loans up to ₹10,00,000, even for less-than-ideal credit scores. In a market that’s constantly shifting and changing, like India, Udyam Flex Loan provides a chance for those in changing conditions to grow and succeed.