How to Find the Perfect MSME Loan to Future-Proof Your Business

Every MSME reaches a moment when growth needs more than effort, it needs capital. It might be a large order you want to accept, a slow month you need to manage, or a piece of equipment that will immediately improve productivity. At times like these, choosing the right MSME loan becomes just as important as choosing the right supplier or business partner.

The problem, however, is deciding which loan actually suits your business. With so many options such as, secured loan, unsecured loan, digital loan, traditional loan, it becomes confusing to understand what will support your growth and what may add unnecessary pressure.

If you are trying to find the quick MSME loan that not only solves immediate needs but also strengthens your business long-term, a clear, structured approach can help you choose with confidence. Let us break it down step-by-step.

Table of Contents

Why Choosing the Right MSME Loan Matters

Most businesses do not take loans because they want to, they take them because the next step demands it. A new supplier contract, a sudden rise in demand, a cash-flow dip, or an important purchase can all push you to explore financing.

But not every loan supports long-term stability. Some create pressure with rigid repayments. Others offer low rates but require heavy documentation or collateral. And a few simply don’t match your business cycle at all.

The right MSME loan does two things:

- Solves the problem you are facing now, whether it is working capital or expansion.

- Strengthens your business for the future, so you are not constantly worried about the next financial hurdle.

A future-proof loan keeps your business flexible, steady, and prepared.

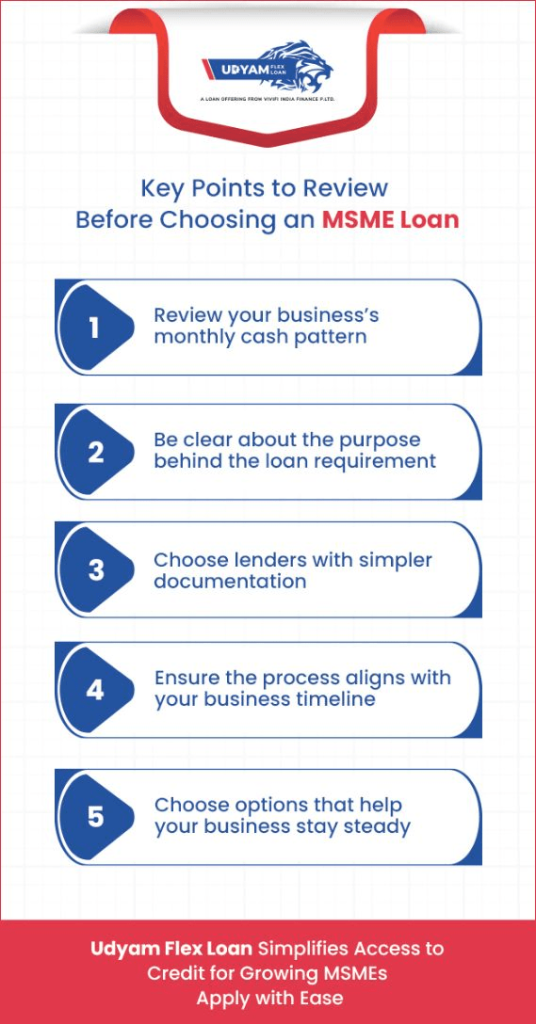

What should you think about before finalising an MSME loan?

- What should you think about before finalising an MSME loan?

- What exactly are you borrowing the loan for?

- Have you checked whether your business can comfortably manage the loan amount?

- Have you compared the different MSME loan options that are available?

- Is the loan offering process simple and time-efficient?

Continue Reading to Know More!

What You Should Evaluate Before Finalising an MSME Loan

Every MSME operates differently, but a few factors matter to all business owners. Before you choose the best MSME loan, take a closer look at these areas.

1. Your Business Cash Flow

Some MSMEs have steady monthly revenue. Others depend on seasonal peaks or client-based billing. Your loan should match this rhythm. If your cash flow fluctuates, a rigid repayment plan can become stressfull.

2. Your Purpose for Borrowing

Loans work best when you are clear about why you need them. Is it for inventory? Working capital? Machine replacement? Expansion? Emergency cash flow support? The more specific you are, the easier it becomes to select the loan structure.

3. Repayment Comfort

Your ideal loan should not force you into tight monthly commitments. It should support operations, not strain them. Many MSMEs underestimate this part and end up choosing loans that do not suit their financial flow.

4. Processing Speed

Business needs do not always wait. Traditional loans may take weeks, while digital MSME loan options can move much faster. Choose based on how urgent your requirement is.

5. Documentation and Eligibility

As a business owner, you do not always have time to gather a long list of documents. Digital-first loans usually keep this simpler, so you can focus on running your business rather than preparing files.

Keeping these factors in mind makes decision-making much clearer.

MSME loan choices: which one fits your business needs?

Not every loan type fits every business. Here is a quick breakdown of common options and when they make sense:

1. Term Loans

These work well for MSMEs planning long-term investments, new machinery, expansion, renovation, or upgrading technology. If your business has steady cash flow and a clear growth plan, term loans can be useful.

2. Working Capital Loans

These are designed for businesses managing everyday operations. If you face seasonal demand shifts, delayed payments, or inventory requirements, working capital loans help maintain stability.

3. Credit Line or Overdraft Facilities

These are ideal for MSMEs with irregular income cycles. You withdraw only what you need and pay ROI on that portion. Traders, service providers, and project-based businesses often rely on this.

4. Collateral-Free MSME Loans

Many micro and small businesses do not have assets to pledge. For them, MSME loans without collateral options are a strong fit. These loans focus on cash flow, business stability, and digital assessments rather than physical collateral.

5. Digital MSME Loans

Digital lenders offer faster processing, easier eligibility checks, and lighter documentation. If you need quick access to funds without long paperwork, this is one of the best MSME loan categories to explore.

Each category solves a different business need. The key is aligning it with your operational style and future goals.

Udyam Flex Loan: How It Helps MSMEs Stay Future-Ready

Udyam Flex Loan is built specifically for micro and small businesses that need a practical and flexible credit option. It focuses on solving two major MSME concerns: timely access to funds and repayment comfort.

Here’s how the product supports MSMEs:

- Collateral-free MSME loan

- Quick and digital process

- Loan amounts up to ₹10,00,000

- Simple eligibility

For MSMEs that want a loan which adapts with their business rather than restricting it, Udyam Flex Loan is a strong option.

Common Mistakes Businesses Make While Selecting a Loan

Even experienced business owners slip into some of these patterns:

1. Borrowing Without Assessing Actual Needs

Not every business needs a large loan. Borrow what fits your situation.

2. Ignoring Cash Flow Reality

If your cash inflow fluctuates, a loan with rigid repayment terms may not be ideal.

3. Waiting Until the Last Minute

Rushed decisions often lead to choosing a loan that does not support future stability.

5. Not Checking Documentation Requirements Early

This prevents surprises and saves time.

Avoiding these mistakes helps you choose the perfect MSME loan that grows with your business.

Conclusion

Finding the right MSME loan for business is not about choosing the most popular option, it is about choosing the loan that matches your cash flow, your challenges, and your goals. The perfect MSME loan helps you manage your immediate needs and prepares your business for what lies ahead.

Udyam Flex Loan is built around these realities. With quick access, flexible features, collateral-free support, and simple documentation, it helps micro and small businesses stay future-ready.

When a loan aligns with the way your business works, it becomes more than credit, it becomes a foundation for growth.