How to Scale a Small Business from ₹2 Lakhs to ₹50 Lakhs Turnover

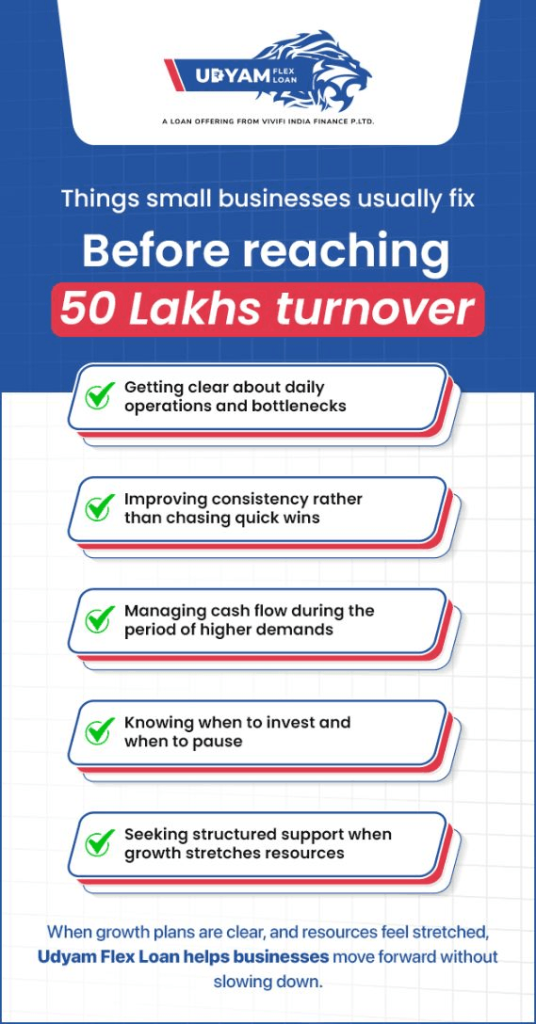

Scaling a business from ₹2 lakhs to ₹50 lakhs isn’t about one big action. It involves fixing many small things, step by step, all while continuing to operate daily. And that’s what makes it challenging.

Table of Contents

The Reality of Scaling a Small Business Beyond ₹2 Lakhs

Scaling sounds exciting, but the reality is often more complex than expected. The challenges don’t appear all at once. They surface gradually as the business starts handling more customers, taking on more responsibility, and facing more expectations.

Understanding what really changes after ₹2 lakhs

At a turnover of ₹2 lakh, most businesses are run very personally. The owner handles almost everything: sales, operations, purchasing, customer communication, and sometimes even accounts. Decisions are quick because the scale is small.

As turnover grows, this approach slowly stops working. More orders mean more coordination. More customers mean more expectations. Mistakes that were manageable earlier start becoming costly.

The shift from ₹2 lakhs to higher numbers requires a mental shift first. You stop running the business only on instinct and start relying on systems, even if they are simple ones. This change feels uncomfortable for many owners, but it’s unavoidable.

Why do many businesses get stuck at the same level

Most small businesses don’t fail. They stall.

They continue operating at the same scale for years because growth feels risky.

Hiring people costs money.

Improving infrastructure needs investment.

Expanding reach requires time and effort, and

The returns are not immediate.

Another common reason is uncertainty. Owners often know they should grow, but they’re not sure what to fix first. Should they focus on sales? Operations? Marketing? Manpower? When everything feels important, nothing moves forward.

This is where clear thinking becomes more valuable than aggressive action.

What helps small businesses scale sustainably in India?

- Strong operational basics

- Consistent customer demand

- Careful cash flow management

- Gradual expansion decisions

- Support that matches the growth stage

Continue reading to understand how businesses scale sustainably

What Actually Drives Small Business Growth from ₹2 Lakhs to ₹50 Lakhs

Growth at this stage isn’t driven by a single decision or investment. It typically results from a series of small, practical changes that gradually enhance daily business operations.

Growth usually starts with fixing the basics

Before aiming for ₹50 lakhs, it helps to look closely at what already exists.

Is the product or service consistent?

Do customers come back, or is every sale a fresh struggle?

Are delays happening because of people, process, or resources?

These questions don’t need fancy answers. Even rough clarity helps.

Many businesses unlock growth simply by tightening daily operations and reducing delays. Improving follow-ups. Making sure suppliers and vendors are reliable. These changes don’t look exciting, but they create space for growth.

Increasing turnover doesn’t always mean adding something new

A common misconception is that growth requires launching new products or entering new markets immediately. Sometimes, growth comes from doing the same thing better.

Small improvements add up:

- Faster delivery

- Better communication

- Slightly improved pricing

- Encouraging repeat customers

- Reducing rework or errors

When these improvements happen together, turnover increases naturally. This is often the safest way to increase turnover in a small business in India, especially when resources are limited.

Cash flow becomes more important as scale increases

As sales increase, expenses usually rise first. More inventory, more people, higher overheads, and Income catches up later.

This gap creates pressure. Many businesses slow down at this stage, not because demand is missing, but because managing cash becomes stressful.

Owners hesitate to take larger orders because they’re unsure if they can manage the upfront costs. This hesitation is one of the biggest invisible barriers to growth.

This is also the stage where many business owners start exploring options like a small business loan in India, not out of desperation, but to avoid missing opportunities.

Using external support doesn’t mean losing control

There’s often hesitation around borrowing. Some owners feel that taking a loan means the business is weak. In reality, loans are tools. Their impact depends on how they’re used.

When aligned with growth needs, a loan can help:

- Manage inventory during expansion

- Support hiring at the right time

- Handle delays in customer payments

- Upgrade tools or equipment

The key is intent. Borrowing to cover confusion leads to problems. Borrowing to support a clear plan usually strengthens the business.

Growth becomes smoother when planning and support meet

This is where structured products like Udyam Flex Loan come into the picture. It’s designed for businesses that are growing but don’t want rigid structures or unnecessary complications.

For businesses transitioning from early-stage operations to higher turnover, having access to flexible support helps maintain momentum. It allows owners to focus on execution instead of constantly worrying about short-term gaps.

Used wisely, this kind of support fits naturally into broader small business growth strategies.

Scaling is rarely linear, and that’s normal

Growth doesn’t happen in a straight line. There will be months where sales jump and months where they slow down. That doesn’t mean the business is failing.

What matters is direction, not perfection.

Breaking the journey into phases helps. ₹5 lakhs, then ₹10 lakhs, then ₹20 lakhs. Each phase brings new learning. Each stage teaches what needs to change next.

Businesses that accept this rhythm tend to grow more steadily than those chasing quick wins.

Reaching ₹50 lakhs is more realistic than it sounds

₹50 lakhs turnover sounds intimidating when you’re at ₹2 lakhs. But when broken down, it becomes manageable.

A few more customers.

Better repeat business.

Slightly higher order values.

Fewer operational gaps.

These aren’t dramatic changes. They’re consistent ones.

Most businesses that reach this level don’t do anything extraordinary. They just make fewer mistakes over time and act consistently when opportunities show up. Growth often reaches a point where planning alone isn’t enough. Even when demand is present and operations are improving, businesses can slow down simply because timing doesn’t align. Expenses show up earlier, while income follows later. This is where structured financial support becomes relevant, as a way to keep momentum intact during growth phases. Udyam Flex Loan is designed for businesses navigating exactly this phase, where demand is growing, but flexibility is needed. With access to loans of up to ₹10 lakhs, it supports MSMEs in managing expansion-related expenses without disrupting daily operations. Scaling a small business from ₹2 lakhs to ₹50 lakhs in turnover is not about rushing. It’s about understanding what needs to change at each stage and being willing to adjust. Strong foundations, operational clarity, and timely decisions create the base for growth. When required, structured support like a small business loan in India, especially options designed for MSMEs like Udyam Flex Loan, can help businesses move forward without stalling. With access to loans of up to ₹10 lakhs, such support can match the scale of growing operational needs while keeping growth steady and manageable. Growth is rarely instant, but it is achievable. And when approached thoughtfully, it becomes far less overwhelming than it initially appears.

How Udyam Flex Loan Supports Businesses During Growth

Conclusion