Why Collateral Free Business Loans Are the Go To for MSMEs Today

Running a small business in today’s market is challenging enough, managing customers, keeping operations smooth, handling suppliers, and ensuring cash flow does not dry up for the month. But when an MSME owner needs extra funds, the pressure intensifies, and they realise they need a loan. Many hesitate to approach lenders because of one major roadblock: collateral.

The idea of pledging property or assets often causes stress, delays, and second thoughts. That is where collateral-free business loans save the day. They offer a practical, faster, and more accessible way for MSMEs to borrow without putting their assets at risk.

Today, these collateral-free loans are becoming the preferred choice for borrowers. And once you understand how flexible, quick, and stress-free they are, it is easy to see why more MSMEs are choosing them to grow, stabilise, and scale their businesses.

Table of Contents

Understanding Collateral Free Business Loans

A collateral-free business loan is exactly what it sounds like. A loan that does not demand property, equipment, or any physical asset as security. Instead of asking what the business owns, lenders look at how the business operates, its income, bank activity, stability, and overall financial behaviour.

This approach makes borrowing easier for micro and small businesses, many of which do not possess large assets to pledge. It also levels the playing field for first generation entrepreneurs who rely on skill rather than inherited property.

Because these loans depend more on the business’s potential and less on its possessions, they have naturally become a practical choice for MSMEs across the country.

Why Are Collateral Free Business Loans Popular Among MSMEs Today?

- No property or assets required for pledging

- Faster approvals and disbursal Simple documentation

- Simple documentation

- Ideal for growing businesses

Continue Reading to Know More!

Why MSMEs Prefer Collateral Free Loans Today

Over the last few years, MSMEs have shifted significantly toward unsecured or collateral free business loans. One major reason is accessibility. Many micro and small business owners simply do not have assets to pledge, or may not want to risk them.

Traditional bank loans often require lengthy paperwork, in person visits, valuations, and several layers of verification. Collateral free loans avoid most of this. They prioritise speed and convenience, which aligns perfectly with how MSMEs operate.

When businesses face seasonal dips, unexpected expenses, supply chain issues, or expansion opportunities, waiting weeks for approval just is not practical. A collateral-free loan bridges that gap and helps MSMEs move quickly.

Key Benefits MSMEs Experience with No Collateral Borrowing

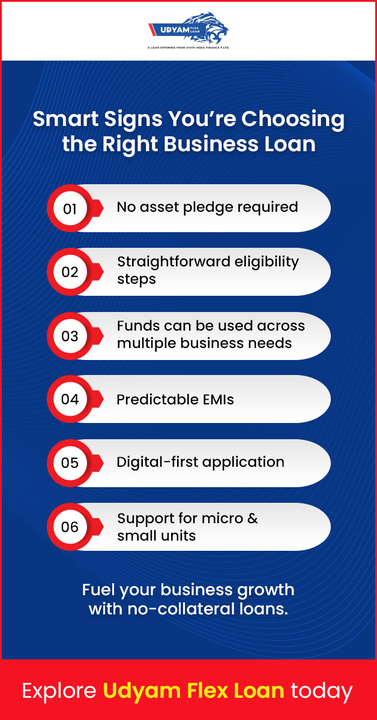

Collateral-free loans offer multiple advantages that directly support small businesses:

1. Faster approvals and disbursals

Since lenders do not need to inspect assets, approvals move faster, often within a short time.

2. Lower paperwork

Without collateral, the paperwork gets simpler, usually basic KYC and financial documents with business history.

3. Reduced financial stress

There is no fear of losing personal or business assets if things do not go as planned.

4. Ideal for MSMEs businesses

MSMEs usually lack collateral; these loans give them a fair chance at securing funds.

These benefits collectively explain the rising adoption of collateral-free financing across India.

Common Misconceptions About Collateral Free Business Loans

Despite their popularity, a few misunderstandings still surround unsecured loans:

- Collateral free loans are always risky – Not necessarily. Reputable NBFCs follow responsible lending practices and evaluate repayment capacity thoroughly.

- They come with complicated terms – Modern digital lenders present clear, simple terms, making the process easy to understand.

- Only large businesses get approved – On the contrary, collateral-free loans are designed especially for micro and small businesses.

- The process takes too long – Digital-first lenders provide faster processing compared to traditional institutions.

Clearing these misconceptions helps MSMEs make more informed borrowing decisions.

How Collateral Free Loans Boost Real MSME Growth

The flexibility these loans offer allows business owners to respond quickly to opportunities. For instance:

- A retailer can restock high demand products.

- A service provider can hire extra staff during peak seasons.

- A manufacturer can repair a machine immediately and avoid downtime.

- Traders can take advantage of bulk purchase discounts.

In each case, the absence of collateral speeds up decision-making. MSMEs can act based on business requirements rather than being held back by asset limitations.

This flexibility is especially helpful in competitive markets where timing can make or break a business opportunity.

Conclusion

Collateral-free business loans have become the preferred choice for MSMEs because they remove the largest obstacle in traditional borrowing, the need to pledge assets. They offer quicker access, simpler processes, and a borrowing experience that fits the fast-moving nature of small businesses.

By focusing on key aspects such as lender credibility, transparent terms, clear disbursal details, and manageable repayment options, MSME owners can make borrowing decisions that genuinely support their growth instead of complicating it.

Solutions like Udyam Flex Loan,offered by

Vivifi India Finance Pvt Ltd, an RBI registered NBFC, follow this transparent and flexible approach. Designed as an instalment-based loan for urgent and essential business requirements, it allows MSMEs to borrow and repay based on their needs, with access to loan limits up to ₹10,00,000 to support working capital, operational expenses, and short-term opportunities.

As the MSME sector continues to expand, collateral free loans give business owners the confidence to handle challenges smoothly and move quickly when promising opportunities come their way.